New York CNN —

The US Consumer Financial Protection Bureau ordered Goldman Sachs and Apple to pay $89 million, and Goldman was temporarily banned from issuing new credit cards, because of the companies’ mishandling of their Apple Card partnership. The failures left customers with unresolved charge disputes and, in some cases, incorrect credit reports.

Apple neglected to send tens of thousands of Apple Card disputes to Goldman Sachs, the CFPB said. When Apple did inform Goldman of disputes, “the bank did not follow numerous federal requirements for investigating the disputes,” according to the CFPB.

The government watchdog said the companies launched their credit card initiative prematurely, even as third parties warned them that the disputes system wasn’t ready for prime time because of tech problems.

“These failures meant that consumers faced long waits to get money back for disputed charges, and some had incorrect negative information added to their credit reports,” the CFPB said in a statement.

The CFPB also found that the companies misled customers about interest-free payment plans for Apple gadgets, including the iPhone. Apple promoted its card’s lack of fees, including annual fees, over-the-limit fees, late fees and foreign transaction fees. But purchases were not free of interest.

An Apple spokesperson, in a statement, said the company strongly disagrees with the CFPB’s characterization of Apple’s conduct but nevertheless aligned with the agency in its order.

“Apple Card is one of the most consumer-friendly credit cards available, and was specifically designed to support users’ financial health,” the spokesperson said. “Upon learning about these inadvertent issues years ago, Apple worked closely with Goldman Sachs to quickly address them and help impacted customers.”

Goldman Sachs, in a statement, said it was pleased to reach a resolution with the CFPB on the matter.

“We worked diligently to address certain technological and operational challenges that we experienced after launch and have already handled them with impacted customers,” a Goldman Sachs spokesperson said.

Goldman was fined $45 million and will have to pay customers $20 million in redress. Apple was fined $25 million.

The CFPB also banned Goldman Sachs from launching a new credit card, “unless it can provide a credible plan that the product will actually comply with the law.”

In a 2022 SEC filing, the bank disclosed that the CFPB was investigating its “credit card account management practices” such as its handling of refunds and billing disputes.

The fine is yet another hit to Goldman’s flailing consumer lending business – this year, it also ended its credit card partnership with General Motors, replaced by Barclays.

The Apple Card issued by Goldman Sachs and running on the Mastercard network rolled out in August 2019. By September 30 of that year, Goldman had already lent out about $10 billion, and customers had $736 million in loan balances.

Goldman broke into the retail consumer business after establishing its online Marcus brand in 2016. Marcus made unsecured personal loans, including to consumers who are dealing with credit card debt.

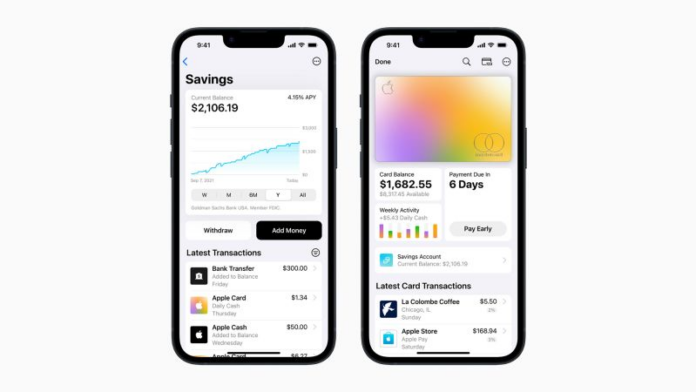

In April 2023, Apple announced it would be offering its Apple Card holders a 4.15% high-yield savings account with Goldman Sachs. They may park both the 3% cash back they receive from using the Apple Card on select purchases plus other savings they may wish to deposit.

Apple and Goldman Sachs ordered to pay $89 million after Apple Card failures

RELATED ARTICLES