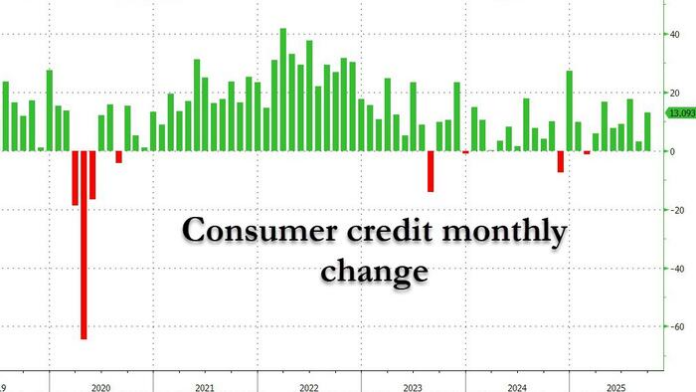

The consumer credit rollercoaster continues.

One month after total consumer credit grew far less than expected, barely printing in the green, moments ago the Fed reported that in September consumer credit jumped once again, rising by $13.093 billion to a new record high of $5.077 trillion.

The increase was driven by a modest rebound by revolving credit, which rose by $1.65 billion in September after contracting in August by the 2nd biggest amount since Covid, shrinking by $6.1 billion (only last November’s $11.2 billion was larger).

The modest increase in revolving credit was more than offset by another solid bounce in non-revolving credit which increased by $9.2 billion, the second biggest increase of 2025.

Broken down by components, student loans – now that the repayment moratorium is over – surged by $27.4 billion in Q3 to a record $1.841 trillion. As discussed previously, student loans have a magical capability of being abused for everything but college, which is why enterprising

Consumer Credit Jumps More Than Expected To New Record High Driven By Surge In Student Loans

RELATED ARTICLES