Acorns, famous for popularizing a debit card which ’rounded up’ purchases to the next dollar to invest, is betting that microinvestors can spare a little more than some pennies for their thoughts investing. Last month, the fintech company began rolling out Money Manager, a new feature which aims to “automate financial wellness” by putting Americans’ direct deposits on autopilot.

“Obviously, knowing our customers really well and the challenges they faced, people don’t know what kind of products they need as a starting point.” Acorns CEO Noah Kerner told TheStreet. “Money Manager is the product that sets up products you need … and automatically allocates the money across products for you based on where you’re at in your life.”

Kerner and Acorns’ philosophy stands in contrast with a fintech industry which has leaned further into burgeoning, speculative opportunities for sources of revenue: options, crypto, and even prediction markets have become a hallmark feature of many investing apps.

But you won’t find that on Acorns, which has focused on a bigger problem: the strategy.

“One part is actually setting up products and letting the customer know what they need in their life to manage their money holistically,” Kerner said. “Then next is people have no idea how much money to put and when, or how you kind of get to those next stages in your life; that’s the core of Money Manager.”

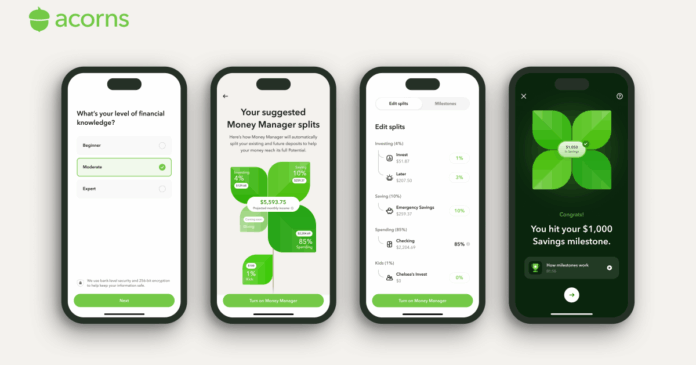

The new feature is simple enough. Acorns asks a few simple questions and invites users to send their paycheck to the service. Then, it’ll handle the rest: building up an emergency fund, before directing funds to spending, retirement accounts, giving, or other Milestones. True to form, Acorns will also design and automate the portfolios in the accounts, taking guesswork out of the savings.

The early indications have been promising, according to the fintech CEO, who says the product has just begun to rollout. However, it isn’t without a big shortcoming. For one, it lacks integration with workplace retirement plans. That’s to be understood, because those contributions come directly out of your paycheck. But by sending your whole paycheck to Money Manager, you might be missing out on an opportunity to unlock the ‘free money’ from your 401(k) or other match-eligible account.

However, Kerner says that as the company rolls out the product, it has noticed users are already saving more money. Kerner says the average customer is saving $693/mo in emergency savings and $175/mo in retirement savings, higher than national averages he cited. He adds that these kinds of savings could preclude everyday Americans from reliance on financial products like buy now, pay later or debt, which have gained a penchant for being adversarial towards lower-income consumers.

In a way, Money Manager is a bit like a budget-builder that puts saving and investing front and center as line items. It’ll tie together Acorns’ existing suite of products, including an AI assistant called Ask Acorns which he says is “evolving into a full financial advisor” and could eventually complement human advice. It’ll also be a big bet for the company which started by rounding up cents: will people who invested pennies be open to investing their whole paycheck?

Its bet is a resounding yes. In 2021, Acorns agreed to go public in a merger with a special purpose acquisition company, or SPAC, at a $2.2 billion valuation. But due to market volatility, the deal was called off. In the last two years, it has focused doing deals of its own, acquiring five companies to beef up its product. It’ll likely result in another visit to Wall Street one day, but Kerner is mum on timing. “We’re very heads down, like delivering on our vision and making the company as sustainable as possible,” Kerner said.

And as for his fintech competition, many of which have been toying around with high-fee, speculative investing products, he laughs: “I’m excited to take on the cast of comic book villains that are running the companies that we compete with.”