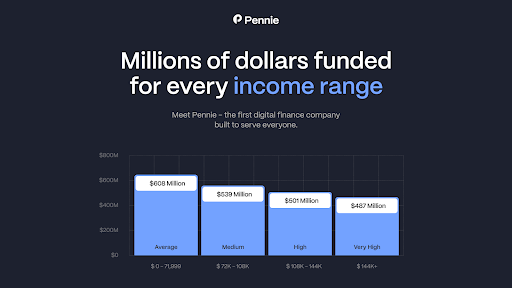

For millions of Americans, a credit score has long been the gatekeeper to financial opportunity. One number — shaped by past circumstances that may no longer reflect current reality — determines who gets approved and who gets turned away. Pennie, the consumer-first loan marketplace at trypennie.com, is challenging that model with an income-focused approach that evaluates borrowers on what matters most: their ability to repay.

Beyond The Credit Score

Traditional lenders treat credit scores as the primary filter, which shuts out borrowers recovering from job loss, medical debt, divorce, or other setbacks. Pennie’s income-focused network takes a different view. The platform connects borrowers with lending partners who evaluate earning power, employment stability, and current financial capacity — not just a three-digit number from the past.

This income-driven approach opens doors for workers with steady paychecks but damaged credit. Gig workers with multiple income streams, essential workers rebuilding after hardship, recent graduates with thin credit files — these are the borrowers traditional lenders overlook. The Pennie platform serves them.