Delta Air Lines is the second biggest airline in North America by passengers carried. It’s also my carrier of choice as a frequent flyer. Through the years, I’ve found that being loyal to Delta and its partners, and holding Delta co-branded credit cards issued by American Express, help me travel smoothly, earn more miles and enjoy perks like upgrades and lounge access.

Meanwhile, our travel editor and a fellow frequent flyer, Kyle Olsen, swears by United Airlines. With a home airport in San Francisco, being loyal to United — which has a worldwide hub at SFO — makes sense for him, but I’m based in New York City, where Delta dominates my home airports of LaGuardia and JFK.

After 25 years as a frequent Delta flyer, I have a good handle on what I can expect from my airline. Here’s why Delta and its credit-card ecosystem work for me and why they might be a good choice for you too.

Airline loyalty can still pay

Among credit card and travel experts it’s commonplace lately to say that airline loyalty is dead, as qualifying for elite status is expensive, lounges are crowded and upgrades are tough to get. Most people, the reasoning goes, don’t need to pursue status by concentrating their flying on one carrier and are better off collecting transferable credit card points rather than airline miles. Those points can then be redeemed for flights in premium classes, with no need to hope for complimentary upgrades based on status.

That makes perfect sense, and that’s what I recommend as well to people who fly a handful of times a year. But for more frequent flyers than that, loyalty still works. My experience illustrates it.

I’ve been a Delta SkyMiles member since 2000 and have held elite status with the program for many of those years. I’ve flown more than 900,000 miles on every airplane type in Delta’s fleet, in every class, from 15 hours across the Pacific in a flat-bed, enclosed pod to domestic hops in the back of a regional jet. Delta’s service and passenger experience have been remarkably consistent across that vast number of miles. Staff recognize my frequent-flyer status often and, most importantly, acknowledge it with tangible gestures like upgrades to first class and priority treatment if trips get snarled by weather or other factors.

Delta and partners have an extensive network

Delta is the dominant airline in New York City. It has almost one flight in three at the JFK airport and even more at LaGuardia, where it accounts for more than 41% of all departures. It’s also in the SkyTeam alliance and has close partners across the globe, serving most of the destinations I typically visit for work and leisure. When traveling to Europe, I can choose among Air France, Dutch flag carrier KLM and Virgin Atlantic; in Asia, there’s giant China Eastern; and LATAM takes me all over Latin America. On all of them, I can earn or spend Delta’s SkyMiles and rack up the Medallion Qualification Dollars (MQDs) needed to attain Medallion elite status. While Delta’s rivals are part of even bigger global alliances, SkyTeam has a couple aces up its sleeve. Those are its hub at the Amsterdam airport, the best in Europe for easy connections in my experience, and Virgin Atlantic, a small airline with exceptional service and lounges.

And wherever I go, Delta usually gets me there when it says it will. In 2024, according to the Bureau of Transportation Statistics, it was the most punctual major carrier in the U.S. — with 82% of flights arriving on time — excepting Hawaiian, which flies where the weather is almost always great. Delta’s top competitors were behind, with United at 79%, American at 75% and hometown carrier JetBlue at 73%.

SkyMiles are good for domestic flights

Another tenet among loyalty experts is that using Delta SkyMiles is a terrible way to book flights. That’s true if you’re after long-haul flights in premium classes, which tend to cost ridiculous amounts of Delta miles. There are far better loyalty programs for booking fancy travel to faraway places. SkyMiles can work well for domestic trips, instead, and I say that from personal experience.

I often book trips from New York to Salt Lake City or Denver, even during ski season, for around 20,000 SkyMiles each way, plus taxes and fees of typically $5.60. Since SkyMiles are worth 1.15 cents each according to The Points Guy, that is the equivalent of less than $240. Not bad at all, especially considering that at least one checked bag is free since I have Delta Medallion status. Another way to get a free checked bag is through Delta co-branded credit cards, and that’s what we’ll look at next.

Delta credit cards can provide a lot of value

Airline-branded credit cards are a useful tool, and they aren’t necessarily only for people loyal to a particular airline. Airline cards with relatively low annual fees but offering a free checked bag can pay for themselves and then some, even if you take two or three flights a year and need to check luggage. In any case, you have several Delta credit cards to choose from.

The Delta SkyMiles® Gold American Express Card can work for occasional Delta flyers. It offers a free checked bag benefit and has an introductory annual fee of $0 for the first year, and then $150 starting at your first renewal (see rates and fees). Since Delta charges $35 for the first checked bag, you don’t have to fly a lot to make the Delta Gold card work for you; it starts making financial sense as soon as the baggage fees surpass the card’s annual fee. That’s why we have included it in our rundown of the best airline credit cards.

Since I am more than an occasional Delta flyer, I prefer holding two other Delta co-branded cards, which help me qualify for Medallion status every year. I would not recommend having more than one of any airline’s co-branded cards to anybody unless they are a truly frequent flyer, but the combination of the Delta SkyMiles® Reserve American Express Card and Delta SkyMiles® Platinum American Express Card works for me.

Each of those cards automatically provides 2,500 of those all-important Medallion Qualification Dollars every year. That’s a boon for Delta flyers seeking to meet the requirements for elite status, which range from 5,000 MQDs earned in a calendar year for Silver Medallion status to 28,000 MQDs for Diamond Medallion status. The Delta Gold card doesn’t provide MQDs.

The Delta Reserve, in particular, is truly valuable for frequent Delta flyers who want lounge access, since it provides access to Delta Sky Clubs. It allows 15 visits per year when flying Delta with a boarding pass for the same day (unlimited visits after spending $75,000 in a calendar year). If I want to bring someone with me into the lounge, the card comes with four one-time guest passes, provided the guest is also flying Delta on the same day (then $50 per person per visit). The Delta Reserve is particularly valuable if your home airport is one of the 15 in the U.S., and 26 worldwide, with an Amex Centurion Lounge, as you have unlimited access to those lounges when flying Delta and booking your flight with the card. That lounge access is what justifies, for me, paying the $650 annual fee of the Delta Reserve (see rates and fees). Sky Club membership starts at $695 per year, so holding the Reserve is cheaper.

The Delta Platinum has an annual fee of $350 (see rates and fees) and is a much better card for people who want to rack up Delta miles but do not need lounge access. While the Reserve earns 3x SkyMiles per dollar spent on Delta purchases and a relatively poor 1x on all other purchases, the Delta Platinum earns the same 3x on Delta purchases but does much better in other categories: It earns 3x on purchases made directly with hotels worldwide, 2x at restaurants worldwide including takeout and delivery in the U.S., 2x at U.S. supermarkets and 1x on all other purchases.

When it comes to other perks, neither card charges foreign transaction fees. I personally charge all Delta tickets to the Reserve, which also offers trip cancellation and interruption insurance*, and the Delta Platinum is one of my go-to cards for grocery shopping.

Both cards offer a first checked bag free on Delta flights (including up to eight companions), plus another feature that can offset the annual fee by itself: an annual companion certificate. Each year, upon renewal of your card, you’ll receive one round-trip companion certificate valid on domestic, Caribbean or Central America flights. That means you can buy one ticket and take another person along, paying only taxes and fees between $22 and $250 (in my experience, taxes and fees have been on the low end of that scale). Certificates from the Reserve card are valid in first class too.

For flights on most other airlines and bookings at hotels, I go outside of the Delta card ecosystem and use the Chase Sapphire Reserve® card. On airfare and hotels booked directly with providers, it earns 4 points for every dollar spent and provides top-notch insurance for delays and cancellations.

Learn how to apply for the Delta SkyMiles® Gold American Express Card.

Learn how to apply for the Delta SkyMiles® Platinum American Express Card.

Learn how to apply for the Delta SkyMiles® Reserve American Express Card.

Learn how to apply for the Chase Sapphire Reserve®.

Upgrades galore

Another plus of the Delta Reserve card is that it acts as tie breaker for complimentary upgrades to first class among flyers with the same elite status. Holding the Reserve and Delta’s top Diamond Medallion status, I get upgraded to first on about 60% of my Delta flights within North America. That’s a remarkable score, proving again that being loyal to the airline works.

On longer flights, I can use what many consider the best benefit of Diamond Medallion status: certificates allowing upgrades anywhere Delta flies. Each Diamond member is issued four Global Upgrade Certificates a year. Those can be used to secure a one-class upgrade on any Delta flight, including the long hauls that do not allow the complimentary upgrades frequent flyers get within North America. That means I can buy coach class, instantly upgrade myself to premium economy — which has the same legroom as domestic first class — and get wait-listed for an upgrade to flat-bed business class, or I can buy premium economy and move up to business right away. That’s a simple way to cross oceans in a much better seat than the one I’ve paid for.

Screens at every seat

In whatever class your seat may happen to be, Delta guarantees something that no other mainline carrier in the U.S. does: a monitor for everyone. Except for regional jets, every Delta airplane has individual entertainment displays at every seat. I don’t always want to watch my phone, bring a tablet or a book or work on my laptop, and that’s why I’m grateful for this perk. Among the competition, JetBlue has monitors at every seat too, but it doesn’t have anywhere near the global reach of Delta.

What Delta can do better

Delta’s Achilles’ heel is an uneven experience in business class, which Delta calls Delta One, and its seats vary widely depending on the aircraft. On Airbus A350s and A330-900s, Delta One is possibly the best business seat in the U.S.: an enclosed pod with your own sliding door, making for exceptional privacy. On earlier models of the A330 and on all Boeing 767s, it isn’t up to that same standard and is noticeably worse than United’s Polaris business class, which is uniformly very good across the airline’s entire fleet of twin-aisle jets. It’s also far behind the best seats on many global airlines that serve the U.S. Delta has world-class maintenance facilities, and even its jets from the 1990s are in great shape, but their age shows in the business seats.

The good news is that, regardless of the plane, if you fly Delta business class, you’ll have access to the exclusive, business-class-only Delta One lounges. Those are the best lounges among all U.S. airlines, and you won’t get in with a credit card. They are open only to passengers in Delta One or business class on some partner airlines. You can find these lounges in Seattle, Boston, Los Angeles and New York JFK, with two more coming soon to Atlanta and Salt Lake City, which is yet another reason I’m going to stick with Delta.

Why trust CNN Underscored

Senior money editor and credit card expert Alberto Riva flies more than 100,000 miles in an average year, many of them with Delta Air Lines. He’s had high-level status with Delta for years and has held Delta co-branded credit cards since 2014. Our recommendations are grounded in real-world value and backed by thorough analysis, expert insight and a commitment to clarity and transparency.

Click here for rates and fees of the Delta Platinum Amex.

Click here for rates and fees of the Delta Reserve Amex.

Click here for rates and fees of the Delta Gold Amex.

*Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

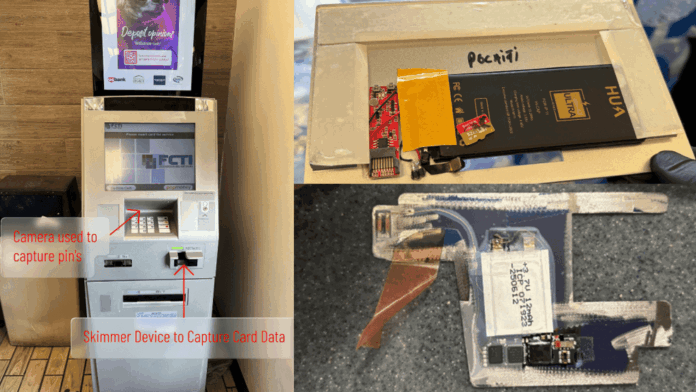

Man arrested after 9 card skimmers found on ATMs and payment methods

RELATED ARTICLES