Investing and trading platform Robinhood (HOOD) is now moving into the housing market. More precisely, after testing the program earlier this year, the company is officially offering discounted mortgage loans to Robinhood Gold subscribers through a partnership with Sage Home Loans. The launch is a major step for Robinhood as it expands beyond stock and crypto trading into personal finance products, such as home lending.

Meet Your ETF AI Analyst

Discover how TipRanks’ ETF AI Analyst can help you make smarter investment decisions

Explore ETFs TipRanks’ users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Through the partnership, Robinhood users can get mortgage rates from Sage that are “at least 0.75% below the national average,” along with a $500 credit toward closing costs for new home purchases or refinances. Sage, which funded more than $750 million in mortgages in 2024, stated that the partnership is part of its goal to make borrowing simpler and more digital. At the same time, Robinhood said the move supports its mission to “democratize finance for all.”

Notably, the mortgage program is available only to Gold subscribers, who pay $5 per month or $50 per year after a free 30-day trial. Borrowers can use Sage’s website to apply for a loan and get a preapproval letter in about four minutes. Interestingly, Yahoo Finance data show that Sage charged median loan costs of approximately $4,642 and offered below-average interest rates of around 6.2% in 2024. For Robinhood, the move into mortgage lending adds to its growing list of services, which already includes fractional share investing and cryptocurrency trading.

Is HOOD a Good Stock to Buy?

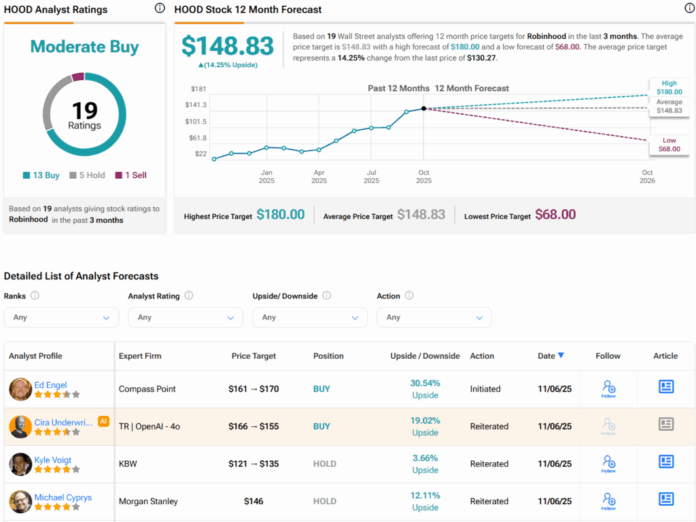

Turning to Wall Street, analysts have a Moderate Buy consensus rating on HOOD stock based on 13 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average HOOD price target of $148.83 per share implies 14.3% upside potential.

See more HOOD analyst ratings