As borrowers prepare to resume student loan repayment after nearly five years of payment pauses and extensions, some people may be looking to save money on interest through student loan refinancing.

Why It Matters

Student loan borrowers have struggled to keep up with payments, even before the federal payment pauses that came as part of the CARES Act in 2020. Findings from the Education Data Initiative show that over 10 percent of borrowers default in their first three years of payment on their student loans.

As of January 2024, about 30 percent of borrowers were past due on payments. Accumulating interest has been a barrier to borrowers paying off their loans and refinancing is one option to get a lower interest rate and decrease the amount that builds up over time.

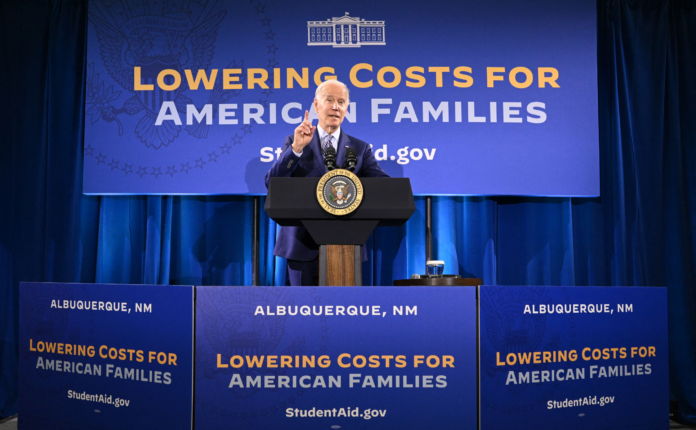

US President Joe Biden speaks about student debt relief at Central New Mexico Community College Student Resource Center in Albuquerque, New Mexico, on November 3, 2022. Borrowers looking to refinance student loans should consider the… US President Joe Biden speaks about student debt relief at Central New Mexico Community College Student Resource Center in Albuquerque, New Mexico, on November 3, 2022. Borrowers looking to refinance student loans should consider the type of loan they want refinanced. More Saul Loeb/Getty Images

What To Know

Federal student loan forbearance, or the temporary pause on loan payments, began for borrowers in March 2020 in response to the COVID-19 pandemic and ended in August 2023.

Millions of borrowers were past due on their payments as of January 2024, according to the U.S. Government Accountability Office, and one in four borrowers said they were struggling to pay their bills in a June Bankrate survey.

Student loan refinancing could be a strategic move for borrowers looking to save money on student loan interest payments, as refinancing often means taking out a new loan with a lower interest rate to pay off an existing loan with a higher rate. A major factor to consider when weighing the option of refinancing is the type of student loan: private vs. federal.

While some private loan lenders only have fixed APRs, or rates that don’t change, others have variable APRs, which do change. Many lenders offer loans with both types of interest.

Why You Should Refinance a Student Loan

If a person has a variable interest rate, they could secure a lower rate through refinance, which could result in